About Us

We focus on understanding your unique needs, providing solutions that work best for you.

Testimonials

We Have Solutions For Everyone

"

"Working with this team has been an absolute game-changer for me. I was struggling to find a loan that fit my needs, and other lenders only made the process more complicated. But from the very beginning, they made everything easy to understand. The application was quick, and I was approved in no time."

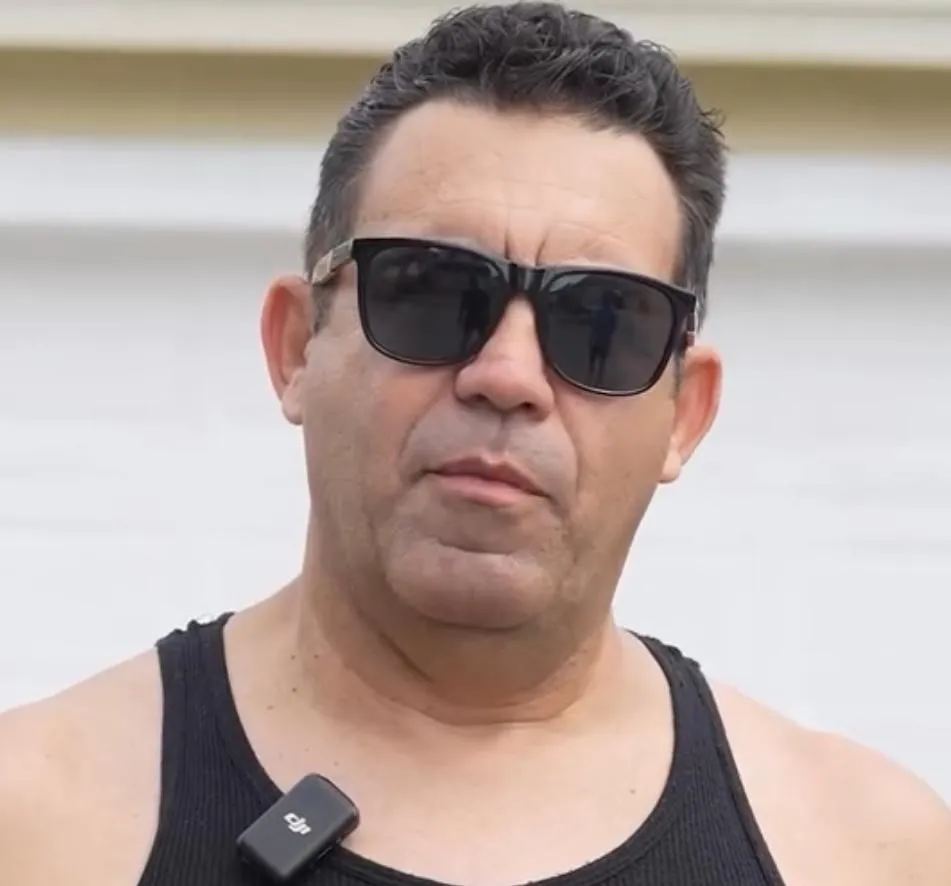

John D.

satisfied client

FAQS

Frequently Asked Questions

What types of loans do you offer?

Business Loans – Funding for operations, growth, or cash flow management.

Lines of Credit – Flexible access to working capital when you need it.

Merchant Cash Advance (MCA) – Revenue-based financing for fast access to funds.

Equipment Financing – Solutions to acquire or upgrade business assets.

Commercial Credit Cards (0% APR Programs) – Strategic credit access without interest for a set period.

How do I apply for a loan?

You can apply easily through our secure online application form. Simply provide your details, and our team will review your application and get back to you with a decision.

What are the loan requirements?

Business Age – At least 3 months in operation.

Monthly Revenue – A minimum of $8,000 in business revenue.

Credit Score – Personal credit of 600+ (used as a guideline, not for reporting).

Documentation – Last 4 business bank statements, a copy of your ID, and a voided business check.

With these, we can usually get you pre-approvals within 24–48 hours.

How long does it take to get approved?

Approval times vary, but most loans are approved within 24 hours. We aim to process applications quickly and keep you informed throughout the process.

What is the interest rate on your loans?

Interest rates depend on the type of loan and your financial profile. We strive to offer competitive rates and provide full transparency with no hidden fees.

Can I pay off my loan early?

Yes, you can pay off your loan early without penalty. We believe in giving you the flexibility to manage your finances as you see fit.

What is the interest rate range?

Repayment options are simple and flexible. You can set up automatic payments or pay manually based on your loan terms.

What if I can’t make a payment on time?

If you're unable to make a payment, reach out to us as soon as possible. We can discuss alternative arrangements to ensure your loan stays on track.

Committed to providing reliable financial solutions with transparency and care. We’re here to support your journey, every step of the way.

About

Our Services

Line of Credit

Business Loan

Personal Credit Consulting

© 2025 Rnueva360 - All Rights Reserved.